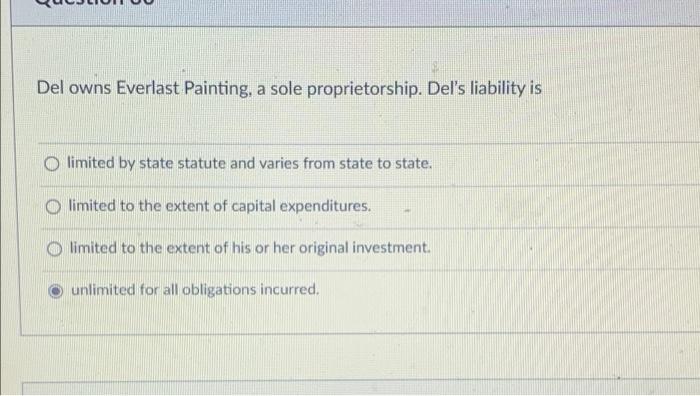

Del owns everlast painting a sole proprietorship del’s liability is – Del owns Everlast Painting, a sole proprietorship, and as such, his personal assets are at risk should the business face legal or financial challenges. This article explores the concept of sole proprietorship, the liabilities associated with it, and strategies Del can employ to mitigate his personal risk.

As a sole proprietor, Del is personally liable for all debts and obligations of Everlast Painting. This means that if the business is sued, Del’s personal assets, such as his home, car, and savings, could be at risk. Additionally, Del is personally responsible for any injuries or damages caused by the business.

Definition of Sole Proprietorship

A sole proprietorship is a type of business owned and operated by a single individual. The owner is solely responsible for all aspects of the business, including its debts and liabilities.

Characteristics of a sole proprietorship include:

- Ease of formation:Sole proprietorships are relatively easy to form, as they do not require any formal paperwork or registration.

- Control:The owner has complete control over the business and its operations.

- Unlimited liability:The owner is personally liable for all debts and liabilities of the business.

- Taxation:Sole proprietorships are taxed as individuals, and the owner’s personal income is subject to income tax.

Liability of a Sole Proprietor

As the owner of a sole proprietorship, the individual is personally liable for all debts and liabilities of the business. This means that if the business is sued, the owner’s personal assets, such as their home, car, and savings, may be at risk.

The unlimited liability of sole proprietorships is a significant drawback of this type of business structure. However, there are some strategies that owners can implement to mitigate their liability, such as:

- Purchasing liability insurance:Liability insurance can help to protect the owner’s personal assets in the event of a lawsuit.

- Establishing a separate business entity:Forming a limited liability company (LLC) or a corporation can help to shield the owner’s personal assets from the liabilities of the business.

Everlast Painting as a Sole Proprietorship

Everlast Painting is a sole proprietorship owned and operated by Del. As the owner of a sole proprietorship, Del is personally liable for all debts and liabilities of the business.

There are a number of potential risks and liabilities associated with Del’s ownership of Everlast Painting, including:

- Financial liability:Del is personally liable for all debts and liabilities of Everlast Painting, including any unpaid bills, taxes, or lawsuits.

- Legal liability:Del is personally liable for any legal violations committed by Everlast Painting, such as violations of environmental laws or employment laws.

- Property liability:Del’s personal property, such as his home and car, may be at risk if Everlast Painting is sued and cannot pay its debts.

Case Study: Del’s Liability for Everlast Painting: Del Owns Everlast Painting A Sole Proprietorship Del’s Liability Is

In a hypothetical scenario, Everlast Painting is sued by a customer who was injured while using one of the company’s products. The customer alleges that the product was defective and caused serious injuries.

As the owner of a sole proprietorship, Del is personally liable for the lawsuit. If the customer is successful in their lawsuit, Del may be ordered to pay damages to the customer. The damages could include compensation for the customer’s medical expenses, lost wages, and pain and suffering.

In addition to the financial liability, Del may also face legal liability for the lawsuit. If the lawsuit alleges that Del was negligent in the design or manufacture of the product, he could be found liable for the customer’s injuries.

Strategies to Mitigate Liability

There are a number of strategies that Del can implement to mitigate his liability as a sole proprietor, including:

- Purchasing liability insurance:Liability insurance can help to protect Del’s personal assets in the event of a lawsuit. The insurance policy would cover the costs of defending the lawsuit and paying any damages that are awarded to the plaintiff.

- Establishing a separate business entity:Forming a limited liability company (LLC) or a corporation can help to shield Del’s personal assets from the liabilities of Everlast Painting. If Everlast Painting is sued, the LLC or corporation would be the defendant in the lawsuit, and Del’s personal assets would not be at risk.

FAQ Insights

What is a sole proprietorship?

A sole proprietorship is a business owned and operated by one person. The owner is personally liable for all debts and obligations of the business.

What are the advantages of a sole proprietorship?

Sole proprietorships are easy to form and operate. They offer flexibility and control to the owner.

What are the disadvantages of a sole proprietorship?

Sole proprietorships offer no personal liability protection. This means that the owner’s personal assets are at risk if the business is sued or faces financial difficulty.